In this article, I argue that the impact of Digital Customer Experience has a significant cushioning effect on demand when the sector is at risk. When a sector or industry is at growth, the effect is positive but less significant compared to when a sector is at risk.

To reinforce my hypothesis, I used the method of logical argumentation and introduced the Digital Customer Experience elasticity of demand. Digital Customer Experience Elasticity of demand is the measurement of the degree of change in demand in response to a change in Digital Customer Experience. See my first article (Part I) for more. In part II of this series, I argue that the impact of Digital Customer Experiences on elastic (comfort and luxury) products is more substantial compared to inelastic (necessity) goods.

But is there a difference when your organization is in an industry or sector that has headwinds (risk) or on the contrary, is at growth? What is the impact of Digital Customer Experience in this case? This article will go deeper conclude on the effect of Digital Customer Experience on both occasions.

Using demand and supply from Economic Theory

Supply and demand are important elements in the economic theory. Supply is the total amount of a goods or services available at a given time at a given price. Demand is the representation of the customers’ desire to purchase these goods and services. Demand as such acts as a measurement of a customers’ willingness to purchase at a given price. These economic forces impact price of goods and services within an economy and the quantities produced and consumed.

In this article I use the demand curve to represent the impact of Digital Customer Experience when demand shifts. The image below outlines the result when demand increases. In increased demand, all other things unchanged, will cause the equilibrium price to rise and the quantity supplied will increase. The equilibrium price is the price at which the quantity demanded equals the quantity supplied. It is determined by the intersection of the demand and supply curves.

Economic theory principles of Demand and Supply

When analyzing and reasoning about the impact of Digital Customer Experience on demand, it is helpful to consider whether the sector (and as such often the organization) is at risk or at growth. In other words, is the investment in Digital Customer Experience under consideration to save current business (organization at risk). Or is it designed to capture new business by offering a new and differentiated experience (organization at growth).

Sector or industry at risk

In any sector, there are moments that existing business is at risk of losing customers because of turmoil, social, economic, or other reasons. Organizations at risk are even more likely to lose unless the organization invests to improve the experience for its existing and dissatisfied customers.

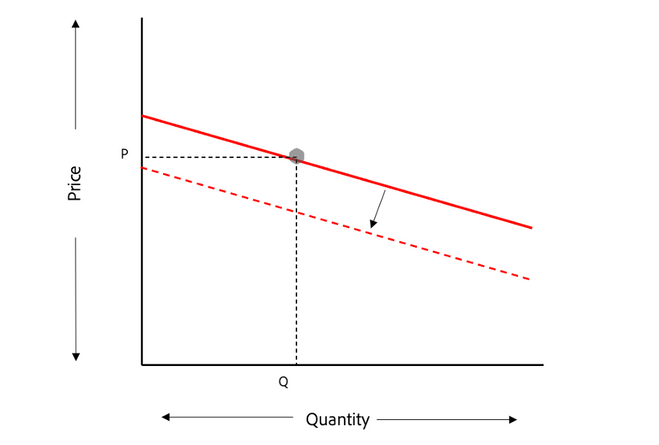

In the context of this article, I state that a sector at risk will lose demand while supply of the market remains consistent. With that in mind, the demand curve will look like this;

Sector at risk will lose demand while supply of the market remains consistent

In the first article of this series, I introduced the Digital Customer Experience curve. The S-shaped curve’ explains how the impact of Digital Customer Experiences is linked with demand. I argued that the slope of the demand curve is steep when customers live all the moments of the relationship beyond the expectation but that the slope flattens when the experiences are above the required expectations.

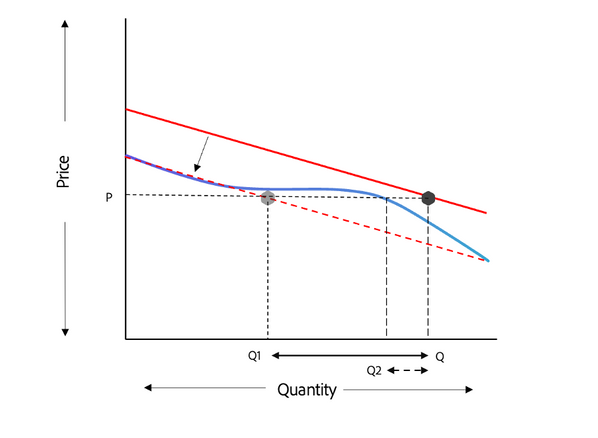

When combining the Digital Customer Experience curve with the decreasing demand curve, I argue that Digital Customer Experiences has a positive cushioning effect on quantity (demand) when an industry is at risk. See below the animation which reflects the difference between Q1 and Q2.

Digital Customer Experiences has a positive cushioning effect on quantity (demand) when an industry is at risk

Without Digital Customer Experience, the quantity decreases from Q to Q1 which is significant. The Digital Customer Experience curve (in blue) has a cushioning effect on the decreased demand curve. The gap between Q and Q2 is significant smaller compared to the gap Q to Q1. The still of the animated image below helps to better analyze the difference.

Digital Customer Experiences has a positive cushioning effect on quantity (demand) when an industry is at risk

Sector or industry at growth

In contrast to a sector at risk, a sector at growth measures the opportunity to capture new demand. This could be due to increasing incomes of consumers. Due to an increase in income, the purchasing power of consumption increases and as such the demand for the product in the market increase.

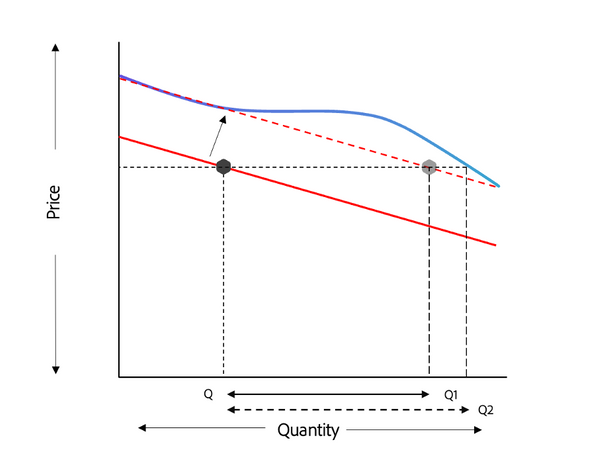

When the demand increases, the demand curve shift to the right. When we apply the same principle by adding the Digital Customer Experience curve on top of the new demand curve, the following image emerges.

Digital Customer Experiences has a positive effect on quantity when a sector is at growth

Notice the difference between Q - Q1 and Q - Q2. The distance between Q and Q1 is the shift of the demand curve to the right (increase of demand). Considering that price remains the same, the Digital Customer Experience curve (blue) moves the quantity demanded to the right (Q2). The distance between Q1 and Q2 is the uplift due to the Digital Customer Experiences.

Therefore, I argue that Digital Customer Experience has a positive effect on quantity when the sector is at growth.

Conclusion

Research on Customer Experience is ongoing and plentiful. But there remain challenges in metrics – how and what to measure, and how the different aspects of Customer Experience impact financial business performance (Gronholdt, 2019). There seems that there is yet consensus on the exact measurements of Customer Experience, but there is convergence that it includes constructs that encompass value, use, quality, and loyalty from the customer perspective.

From a Business Economics perspective, it is also clear that it should be measured to company financial impact so that CX is used to build business (Bones & Hammersly, 2017).

In this series on Digital Customer Experience Elasticity, I took the simple economic theory principle of supply and demand. This last article depicts the impact of a sector or industry at growth or at risk and which impact Digital Customer Experience has on demand (keeping price the same).

I argue that the impact of Digital Customer Experience has a significant cushioning effect on demand when the sector is at risk. When a sector or industry is at growth, the effect is positive but less significant compared to when a sector is at risk.

In the next and last article, I conclude all the hypothesis I made in this series about Digital Customer Experience Elasticity of demand.Subscribeto my newsletter to stay informed.

References

Bones, C., & Hammersley, J. (2017). Leading digital strategy: Driving digital strategy: Driving business growth through effective e-commerce, The Journal of Decision Makers, 42(2), 128-132. doi: 10.1177/0256090917703755

Gronholdt, L. (2019). Digital customer experience: An emerging theme in customer service excellence. Newsletter on Consumer Behavior 31, 2-10. Last retrieved on February 2, 2020 from https://research.cbs.dk/en/publications/digital-customer-experience-an-emerging-theme-in- customer-service

University of Minnesota, Principles of Economyhttps://open.lib.umn.edu/principleseconomics/chapter/3-3-demand-supply-and-equilibrium/#:~:text=An%20increase%20in%20demand%2C%20all,fall%3B%20quantity%20supplied%20will%20decrease.